As we navigate the dynamic landscape of digital advertising in 2025, ad network platforms continue to evolve, driven by technological advancements and shifting consumer behaviors. These platforms serve as vital intermediaries connecting publishers with advertisers, facilitating targeted ad placements across websites, apps, and emerging media channels. This comprehensive guide delves into the latest trends in ad network platforms, key challenges facing ad networks in 2025, and promising opportunities for digital ad networks, providing actionable insights backed by industry data to help publishers, marketers, and businesses optimize their strategies for sustainable growth.

Emerging Trends in Ad Network Platforms for 2025

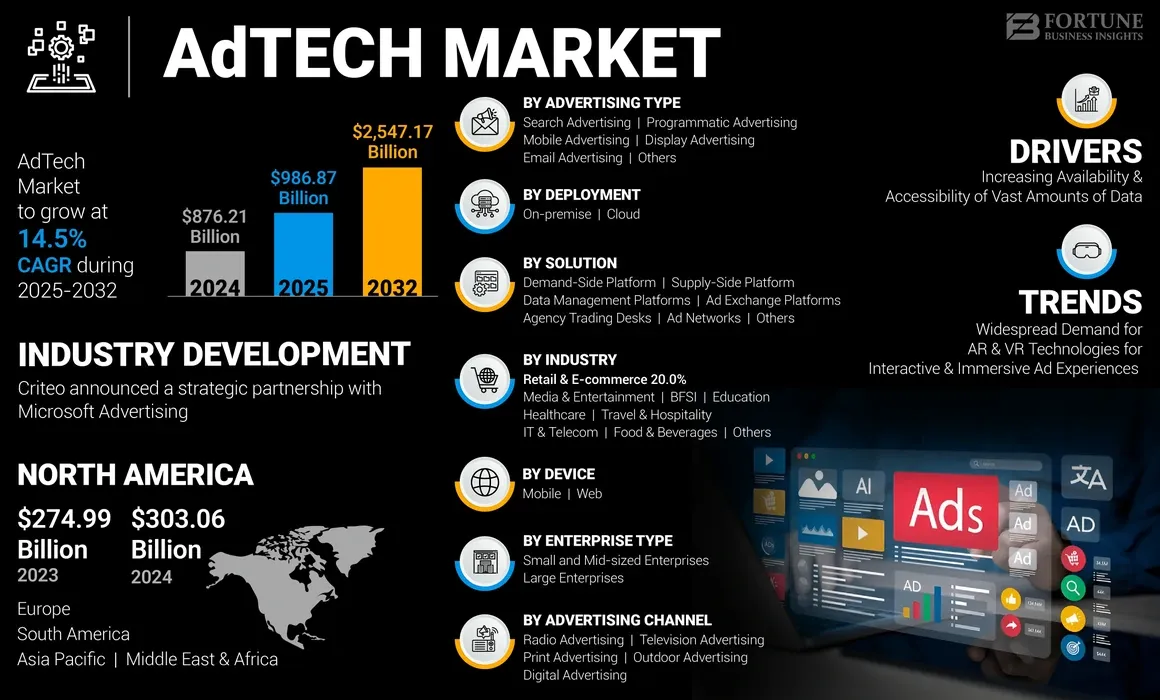

The ad network platforms 2025 scene is marked by rapid innovation, with AI and privacy regulations reshaping how ads are delivered and monetized. According to recent reports, the global AdTech market is projected to grow at a CAGR of 14.5% from 2025 to 2032, reaching $2,547.17 billion by 2032. This growth underscores the need for platforms to adapt to hyperscale social video, AI-driven personalization, and retail media networks.

AI Integration and Personalization

One of the most prominent trends in ad networks 2025 is the integration of artificial intelligence for hyper-personalized ad experiences. AI tools now analyze vast datasets to predict user preferences, enabling platforms to deliver contextually relevant ads with unprecedented accuracy. For instance, programmatic advertising trends highlight AI’s role in optimizing bids in real-time, reducing waste and improving ROI. Platforms like those leveraging machine learning can increase engagement by up to 30%, as ads become more tailored to individual behaviors without relying on invasive tracking.

Rise of Contextual Targeting

With the decline of third-party cookies, contextual advertising networks are surging. In 2025, top platforms prioritize content-based targeting, analyzing page context rather than user data. This shift not only complies with privacy laws but also boosts ad relevance—studies show contextual ads can achieve 20-50% higher click-through rates compared to traditional methods. Leading networks are incorporating natural language processing to match ads with article sentiment and topics seamlessly.

Growth of Connected TV (CTV) and Video Ads

Video ad networks 2025 are booming, with shorter formats dominating due to shrinking attention spans. Trends indicate video ads under 15 seconds perform best, capturing 2x more views than longer ones. CTV platforms, integrated into ad networks, are expected to see explosive growth, with ad spend on connected devices surpassing $30 billion globally. This trend opens doors for interactive ads on streaming services, blending entertainment with commerce.

Expansion of Retail Media Networks

Retail media is a game-changer among digital ad network trends, with off-site ad spending projected to exceed e-commerce display ads in 2025. Platforms like Amazon and Walmart’s networks allow brands to target shoppers at the point of purchase, leveraging first-party data for precision. This integration with e-commerce ecosystems is reshaping ad network platforms, offering higher conversion rates—up to 18% better than standard display ads.

To visualize these trends in ad network platforms 2025, here’s an infographic highlighting market growth and key drivers:

Mobile and Immersive Ad Experiences

Mobile-first strategies dominate future trends in ad networks, with AR/VR technologies enabling immersive ads. By 2025, widespread demand for augmented reality ads is expected, allowing users to interact with products virtually. Ad networks are adapting by supporting formats like shoppable videos, which can boost purchase intent by 25%.

Key Challenges Facing Ad Network Platforms in 2025

While opportunities abound, challenges in ad networks 2025 pose significant hurdles. From privacy concerns to ad fraud, platforms must navigate a complex environment where data scarcity and regulatory pressures threaten efficiency.

Privacy Regulations and Data Deprecation

The biggest challenge facing digital ad platforms is the ongoing phase-out of third-party cookies and stringent laws like GDPR and CCPA. By 2025, 54% of marketers plan to reduce ad spend due to these constraints, forcing networks to pivot to privacy-first models. This deprecation limits targeting accuracy, potentially reducing CPMs by 10-20% for non-compliant platforms.

Ad Fraud and Invalid Traffic

Ad fraud remains a top threat, with global losses projected at $100 billion in 2025. Sophisticated bots and click farms challenge ad network platforms, eroding trust and revenue. Networks without robust AI detection risk higher invalid traffic rates, up to 25% in vulnerable sectors.

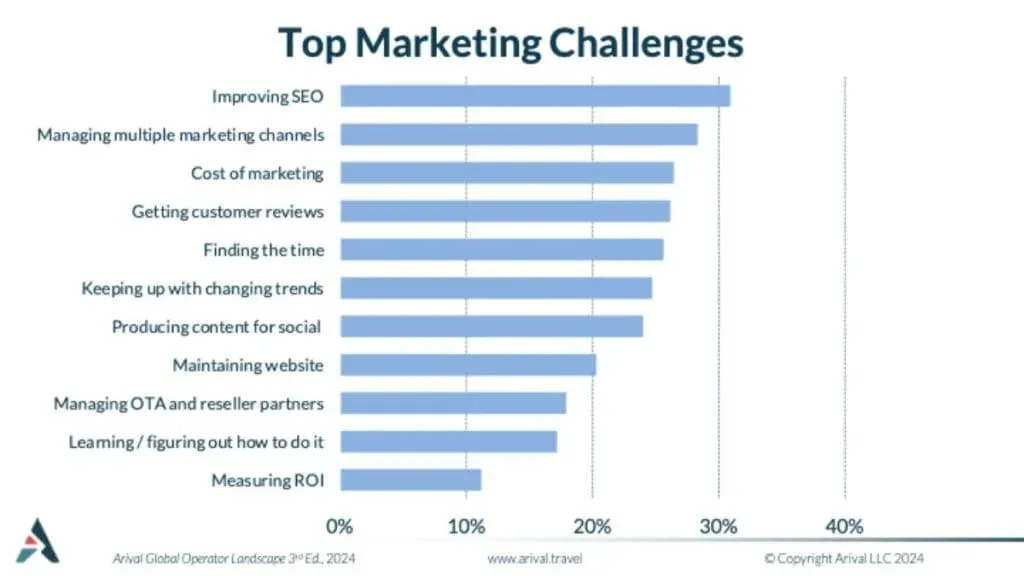

Media Fragmentation and Measurement Issues

With audiences scattered across platforms, challenges in digital advertising networks include media fragmentation. Measuring ROI across channels is tough, especially with limited high-quality data. Retail media networks face integration issues with third-party DSPs, complicating attribution and leading to inconsistent metrics.

Rising Costs and Ad Blocker Penetration

Cost pressures are mounting, with ad production and placement expenses rising amid economic uncertainties. Ad blockers, used by over 40% of users, further diminish reach, forcing networks to innovate with non-intrusive formats.

This chart illustrates the top challenges in digital advertising 2025, based on industry surveys:

Publisher Mistakes in Network Selection

Publishers often err by signing long-term contracts or relying on promised rates, leading to suboptimal partnerships. In 2025, choosing networks without evaluating fill rates or support can result in 15-30% revenue loss.

Opportunities for Growth in Ad Network Platforms

Despite challenges, opportunities in ad network platforms 2025 are vast, particularly in leveraging first-party data and emerging technologies. The digital ad spend hit $137 billion in the US alone, with impressions exceeding 16 trillion, signaling robust potential.

Leveraging First-Party Data and Transparency

The shift to first-party data presents a major opportunity for digital ad networks, enabling more accurate targeting without privacy risks. Platforms emphasizing transparency in data usage can build trust, with 74% of marketers favoring retail media for its reliable insights. This trend could increase RPMs by 20-50% through header bidding and direct deals.

Expansion into Video and Push Advertising

Video ad networks offer high-engagement opportunities, with push notifications yielding CPMs up to $10. Networks like those specializing in short-form video can capitalize on social platforms’ growth, where EGC (employee-generated content) is declining in favor of authentic, AI-assisted creatives.

Retail Media and E-Commerce Integration

Retail media ad networks 2025 are poised for dominance, with top networks like Amazon and Walmart expanding off-site capabilities. This integration creates opportunities for cross-channel campaigns, potentially capturing 46% of regulated advertiser budgets.

AI-Driven Optimization and New Formats

AI’s prominence offers future opportunities in ad platforms, from automated creative generation to predictive analytics. Networks adopting these can reduce production time by 40% and enhance personalization.

Here’s a forward-looking image on opportunities in ad networks:

Global Reach and Niche Specialization

For publishers, diversifying with multiple networks unlocks opportunities, especially in niches like gaming or finance. International platforms can tap into emerging markets, where mobile ad growth is accelerating.

Ad Policies and Responsible Advertising

In 2025, responsible advertising is paramount for ad network platforms. Adhere to FTC guidelines by clearly labeling sponsored content and avoiding deceptive practices. Prioritize user consent in data collection, implement anti-fraud measures, and promote inclusivity in ad creatives. Networks should enforce policies against harmful content, ensuring ads align with brand safety standards to foster long-term user trust and compliance with global regulations.

Most Trusted Platforms

- Google Ads: The leading platform for contextual and display ads, offering robust AI tools and global reach for maximized ROI in 2025.

- Amazon Advertising: Top retail media network, excelling in e-commerce integration and first-party data for targeted campaigns.

- Meta Ads: Ideal for social and video advertising, with advanced personalization features driving high engagement across platforms.

Explore logos of these top ad network platforms 2025 for visual reference:

FAQs

1. What are the top trends in ad network platforms for 2025? AI personalization, CTV growth, and retail media expansion are key, with market growth projected at 14.5% CAGR.

2. What challenges do ad networks face in 2025? Privacy regulations, ad fraud, and data limitations are major hurdles, with fraud losses at $100 billion.

3. How can publishers overcome challenges in digital ad networks? By adopting first-party data and AI fraud detection, while avoiding common mistakes like rigid contracts.

4. What opportunities exist for growth in ad network platforms? Leveraging video ads, transparency, and retail integrations can boost revenue by 20-50%.

5. Which are the best ad network platforms in 2025? Google Ads, Amazon Advertising, and Meta Ads stand out for their reliability and features.

6. How does responsible advertising impact ad networks? It builds trust, ensures compliance, and reduces ad blocker usage through ethical practices.

Conclusion

In summary, ad network platforms in 2025 are at a pivotal juncture, with trends like AI and CTV driving innovation, while challenges such as privacy and fraud demand adaptive strategies. By capitalizing on opportunities in retail media and first-party data, stakeholders can achieve sustainable success in this $1 trillion+ industry. Stay ahead by testing new formats, prioritizing ethics, and leveraging data-driven insights.

For more in-depth strategies on navigating ad network platforms, visit TrafficBets.com.